Mastering the 409A Valuation Process: Expert Tips and Strategies

Decoding the intricacies of 409A Valuation

Embarking on the journey to master the 409A valuation process requires a deep understanding of its intricacies. This guide is designed to provide expert tips and strategies, empowering businesses to navigate the complexities of the 409A valuation with confidence.

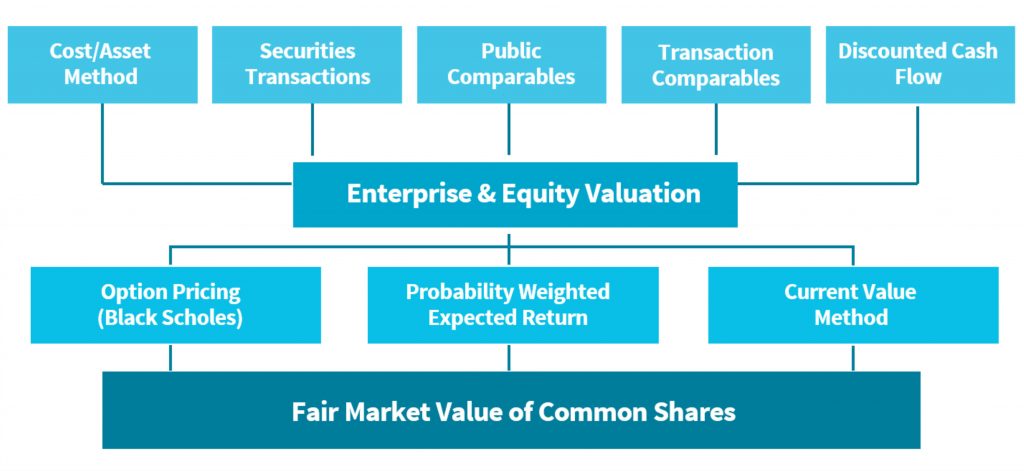

Unveiling the Key Components of 409A Valuation

Before diving into tips and strategies, it’s essential to unveil the key components of the 409A valuation. From market conditions to financial projections, each element plays a crucial role in determining the fair market value of a company’s common stock.

Leveraging Technology for Precise Valuations

In the era of technological advancement, leveraging cutting-edge tools and software can enhance the precision of 409A valuations. Expert tip: Invest in valuation platforms that incorporate real-time data analytics and predictive modeling for a more accurate assessment.

Expert Tips for a Seamless Valuation Process

Seasoned professionals know that mastering the 409A valuation process goes beyond understanding its basics.

Proactive Data Preparation

One key tip is to be proactive in data preparation. Ensure that all financial records, market analyses, and other relevant data are organized and readily available. This proactive approach streamlines the valuation process and minimizes delays.

Collaborate with Cross-functional Teams

Valuation is not a siloed activity. Engage with cross-functional teams, including finance, legal, and operations. Their insights can provide a holistic view of the company, contributing to a more comprehensive and accurate valuation.

Strategies for Overcoming Valuation Challenges

Even with expertise, challenges can arise during the 409A valuation process. Strategies are essential for overcoming these hurdles.

Dynamic Modeling for Burstiness

Addressing the burstiness inherent in startup dynamics requires dynamic modeling. Adopt strategies that account for rapid changes in cash flows, market conditions, and other variables, ensuring a valuation that reflects the dynamic nature of the business.

Continuous Monitoring and Adjustments

Valuation is not a one-time event. Implement strategies for continuous monitoring and adjustments. Regularly reassess the valuation in light of changing market trends and business developments, maintaining accuracy over time.

Conclusion: A Masterful Approach to Valuation Excellence

In conclusion, mastering the 409A valuation process involves a combination of in-depth knowledge, expert tips, and strategic approaches. By decoding its intricacies, implementing proactive measures, and addressing challenges with precision, businesses can achieve valuation excellence. Remember, the 409A valuation is not just a compliance requirement; it’s a strategic tool that, when mastered, contributes to informed decision-making and sustainable business growth.